STUDY: Dems’ Supercharged Second Death Tax Kills at Least 800,000 Jobs, Slashes Paychecks

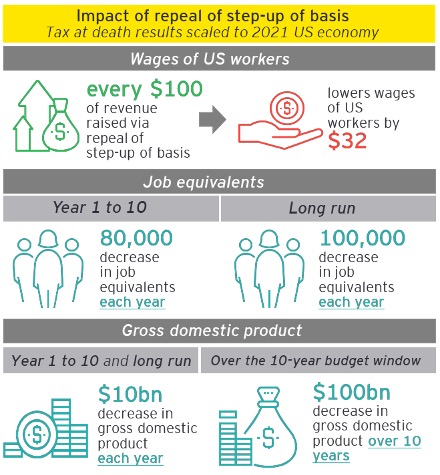

Democrats’ supercharged second death tax on farms, factories, and other small businesses would kill 800,000 jobs over 10 years, and even more after that, while slashing paychecks for workers by $32 for every $100 in revenue raised, according to a new economic analysis by the Family Business Estate Tax Coalition. The study, produced by EY, looks at Democrats’ pledge to repeal “stepped-up basis,” which makes it possible for a family business—like a farm—to pass from one generation to the next without being forced to sell off assets to pay an exorbitant tax bill.

Takeaways:

- The study shows that the supercharged second death tax would harm workers, killing “80,000 jobs in each of the first ten years, and 100,000 jobs each year thereafter.”

- For every $100 of revenue raised by repeal via tax at death the wages of workers would decline $32. Nearly one-third of every dollar of revenue raised comes out of the paychecks of US workers.

- This supercharged second death tax would decrease US GDP by $10 billion annually or $100 billion over 10 years.

- Finally, the new tax would gravely harm family-owned businesses with significant financial and administrative problems, “limiting the business’ viability as an ongoing concern.” This is on top of the existing death tax, which Democrats plan to keep in place.