On April 24, 2024, Ways and Means Committee Chairman Jason Smith (MO-08) and Tax Subcommittee Chairman Mike Kelly (PA-16) announced the formation of ten Committee Tax Teams, comprised of Ways and Means Republican members, to study key tax provisions from the 2017 Trump tax cuts that are set to expire in 2025 and identify legislative solutions that will protect Americans from a multitrillion dollar tax increase.

To date, Ways and Means tax teams have held over 120 events across 20 states to hear directly from the American people.

News

Chairman Smith at Las Vegas Field Hearing: The One, Big, Beautiful Bill Delivers Lower Taxes and a Bigger Paycheck

Today, Ways and Means Committee Chairman Jason Smith (MO-08) delivered the following opening statement at a field hearing in Las…

July 10, 2025Big Beautiful Success Story: Opportunity Zone Improvements in The One, Big, Beautiful Bill Focus on Rural Areas and “Helps Increase Transparency” in Program

WASHINGTON, D.C. – Improvements to the Opportunity Zone (OZ) program, which encourages greater investment in distressed communities, will result in more…

July 9, 2025Big Beautiful Success Story: Tax Cut Permanence Means Greater Investment in America’s Economy

WASHINGTON, D.C. – After years of uncertainty about expiring tax provisions, American manufacturers and workers are celebrating the stability and certainty provided…

April 21, 2025STUDY: Extending Trump Tax Cuts Would Boost Jobs, Wages, and Economic Growth

A new study from the Council of Economic Advisers (CEA) confirms what working families and small business owners have long…

April 15, 2025Chairman Smith on Tax Day: Republicans Are Ready to Deliver on an America First Tax Policy

WASHINGTON, D.C. – Days after Congress took a major step in unlocking the reconciliation process to provide tax relief for working…

March 27, 2025ICYMI: Chairman Smith on Squawk Box: “We’re going to deliver for the American People.”

WASHINGTON, D.C. – Ways and Means Committee Chairman Jason Smith (MO-08) joined CNBC’s Squawk Box Wednesday to discuss the latest…

The Ways and Means Committee has launched a new comment portal where stakeholders and members of the public can share information on the impact those higher taxes will have on their families, businesses, and communities.

How to Submit Written Comments to the Tax Teams

- Any person(s) or organization(s) wishing to submit comments may e-mail RepublicanTaxTeams@mail.house.gov.

- In the subject line or body of the e-mail, please indicate: “Tax Teams Comment on [name of relevant Tax Team(s)].”

- Please attach the written submission as a Word document.

- In the attachment or body of the e-mail, please include a contact name and phone number or e-mail address.

- For questions or technical assistance, please call (202) 225-3625.

Tax Teams

Latest Team News

Rep. Buchanan Op-Ed: Congress must act to prevent ‘tax Armageddon’

Washington Examiner

JULY 19, 2024

Press Release: NAM Hosts Congressional Leaders in Tax Fight Kickoff

National Association of Manufacturers

JUNE 28, 2024

Manufacturing Tax Team Members met with the National Association of Manufacturers

During this discussion, Members heard about the tax implications of 2025 on the manufacturing sector.

In Detroit, MI, American Manufacturing Chair Buchanan led a roundtable to discuss tax priorities for multinational manufacturers.

American Manufacturing Tax Team Members heard from Magna International Manufacturing Company about their tax priorities in 2025.

Members received a tour of Magna International Manufacturing Company’s warehouse.

Latest Team News

Press Release: ICYMI: LaHood Leads Ways and Means American Workforce Tax Team Roundtable with Local Rockford Businesses

Rep. Darin LaHood

SEPTEMBER 19, 2024

News Coverage: Congressman LaHood visits Rockford to check in as the Tax Cuts and Jobs Act legislation gets set to expire

SEPTEMBER 16, 2024

News Coverage: Rockford-area Republican, Democrat lawmakers prepare for tax ‘Super Bowl’

SEPTEMBER 16, 2024

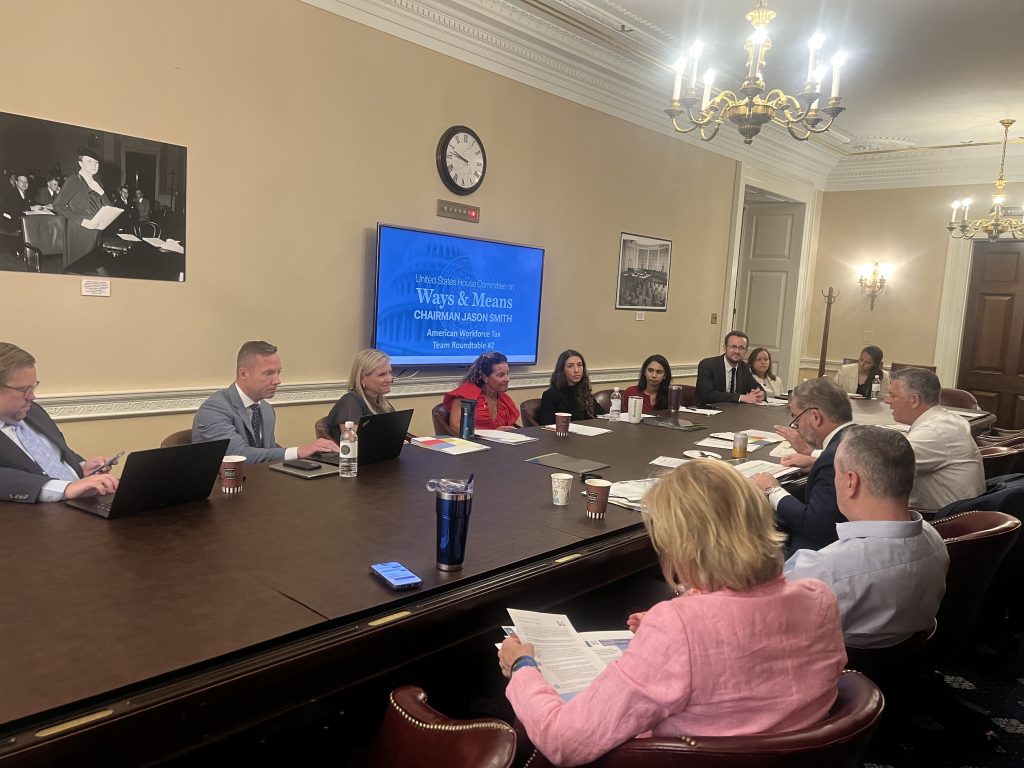

The American Tax Workforce hosted a roundtable discussion covering pro-family and pro-worker tax policy.

During this roundtable, Members heard about the importance of protecting the Trump Tax Cuts for small businesses, workers, and families.

At Collins Aerospace in Rockford, IL, American Workforce Team Members heard about the positive impact of TCJA and the need to maintain and improve policy that reduces taxes and enables small businesses and workers to thrive.

Rep. Darin LaHood (IL-16) visited two Low-Income-Housing Tax Credit projects in his district to hear about how the tax code can help the development of new housing for low to middle-income families.

Latest Team News

Press Release: Rep. Van Duyne Holds Tax Roundtable in Grand Prairie with Local Business Leaders

Rep. Beth Van Duyne

OCTOBER 16, 2024

Press Release: Smucker’s Main Street Tax Team Hosts Roundtable with Small Businesses

Rep. Lloyd Smucker

AUGUST 2, 2024

Chairman Smucker Leads Main Street Tax Team Field Event with Keller-Brown Insurance Services in Shrewsbury, PA

AUGUST 1, 2024

Press Release: Rep. Greg Steube Holds Main Street Employers Coalition Roundtable to Discuss Preserving President Trump’s Pro-Small Business Tax Policies

Rep. Greg Steube

JUNE 21, 2024

Latest Team News

Rep. Feenstra Op-Ed: Pro-growth tax policies support our rural communities

Times Republican

AUGUST 19, 2024

Latest Team News

Press Release: Rep. Mike Kelly leads Ways & Means Tax Team tour addressing affordable housing

Rep. Mike Kelly

JULY 26, 2024

Press Release: Kelly leads Community Development Tax Team, holds first site visit to DC Opportunity Zone project

Rep. Mike Kelly

JULY 11, 2024

Rep. Mike Kelly kicked off the committee’s Tax Teams site visits with a stop at The Bridge District in Washington, D.C.

Rep. Mike Kelly kicked off the committee’s Tax Teams site visits with a stop at The Bridge District in Washington, D.C.

Rep. Mike Kelly kicked off the committee’s Tax Teams site visits with a stop at The Bridge District in Washington, D.C.

Rep. Mike Kelly kicked off the committee’s Tax Teams site visits with a stop at The Bridge District in Washington, D.C.

Rep. Mike Kelly kicked off the committee’s Tax Teams site visits with a stop at The Bridge District in Washington, D.C.

Community Development Tax Team visiting a Low-Income Housing Tax Credit project in Washington, D.C.

Community Development Tax Team visiting a Low-Income Housing Tax Credit project in Washington, D.C.

Community Development Tax Team visiting a Low-Income Housing Tax Credit project in Washington, D.C.

Community Development Tax Team visiting a Low-Income Housing Tax Credit project in Washington, D.C.

Community Development Tax Team member, Rep. Mike Carey (OH-15), toured an apartment complex in Columbus, Ohio that serves senior citizens over the age of fifty-five. Following the creation of Opportunity Zones in the 2017 Trump tax cuts, the apartment complex received a million-dollar renovation that could have only been made possible by the economic development tool.

Rep. LaHood met with members of the Critical Labor Coalition to discuss the Work Opportunity Tax Credit and how it bolsters the American workforce.

Latest Team News

Press Release: Kustoff Holds Tax Roundtable with Tennessee Business Leaders

Rep. David Kustoff

OCTOBER 2, 2024

Rep. Miller Op-Ed: Raising the Corporate Tax Rate Will Hurt American Business, Investment, and Consumers

Fortune

SEPTEMBER 25, 2024

Press Release: Miller’s Supply Chains Tax Team Hosts Roundtable, Tours Oil and Gas Rig

Rep. Carol Miller

JULY 26, 2024

Supply Chains Tax Team Chairwoman Miller Hosts Former Chairman Kevin Brady

JULY 24, 2024

Press Release: Miller’s Supply Chains Tax Team Hosts Roundtable, Tours CNX’s Mine Methane Capture Facility

Rep. Carol Miller

JULY 12, 2024

Press Release: Congressman Kustoff Hosts Economic Roundtables Across West Tennessee

Rep. David Kustoff

JUNE 21, 2024

Rep. Carol Miller hosted a roundtable with CNX and stakeholders in the energy industry and toured CNX’s Mine Methane Capture Facility.

Rep. Carol Miller hosted a roundtable with CNX and stakeholders in the energy industry and toured CNX’s Mine Methane Capture Facility.

Rep. Carol Miller hosted a roundtable with CNX and stakeholders in the energy industry and toured CNX’s Mine Methane Capture Facility.

Rep. Carol Miller hosted a roundtable with CNX and stakeholders in the energy industry and toured CNX’s Mine Methane Capture Facility.

Rep. David Kustoff held roundtables with financial leaders across west Tennessee in Hardin County, Shelby County, and Madison County to discuss priorities for a potential economic and tax package.

Rep. David Kustoff held roundtables with financial leaders across west Tennessee in Hardin County, Shelby County, and Madison County to discuss priorities for a potential economic and tax package.

Rep. David Kustoff held roundtables with financial leaders across west Tennessee in Hardin County, Shelby County, and Madison County to discuss priorities for a potential economic and tax package.

Rep. David Kustoff held roundtables with financial leaders across west Tennessee in Hardin County, Shelby County, and Madison County to discuss priorities for a potential economic and tax package.

Congresswoman Miller at roundtable.

Touring the oil and natural gas rig.

Chairwoman Miller and Vice Chairman Kustoff held a discussion with the National Association of Manufacturers about how lowering the corporate rate will create more jobs for American manufacturers.

Latest Team News

Press Release: Chairman Smith Holds Ways & Means Tax Teams Event in Kansas City, Missouri

Ways & Means Committee

OCTOBER 8, 2024

Press Release: Rep. Estes Leads Innovation Tax Team Event in Silicon Valley

Rep. Ron Estes

SEPTEMBER 17, 2024

Press Release: Rep. Estes Wraps Up Kansas Innovation Visits, Announces Silicon Valley Visits

Rep. Ron Estes

SEPTEMBER 11, 2024

Latest Team News