WASHINGTON, D.C. – House Republicans took the first step to advance President Trump’s pro-worker, pro-America economic and national security agenda by passing a fiscally-sound budget resolution. This sets the stage to extend the successful Trump tax cuts, provide new tax relief to American workers, small businesses, and families, and deliver on enhanced border security, stronger national security, and more American-made energy. This budget will help fulfill the mandate given to President Trump by the American people to undo the harm done by years of failed Democrat policies.

Every House Democrat voted against cutting reckless government spending that has fueled high prices, against preventing tax increases on American families, small businesses and workers, and against helping America’s brave Border Patrol and military protect the homeland.

During debate on the budget, Ways and Means Committee Chairman Jason Smith (MO-08) urged the House and Senate to act swiftly to give small businesses and working families the certainty that their taxes will not increase in just a few months:

“Right now, the average taxpayer will see a 22 percent tax hike if Congress fails to act. The average family of four will see their taxes go up by almost $1,700 – that’s two months’ worth of groceries…These families, farmers, workers, and small businesses need certainty that relief is on the way so they can thrive once again.

“Protecting and building on President Trump’s signature tax cuts will deliver an America First economy to usher in a new golden age of prosperity”

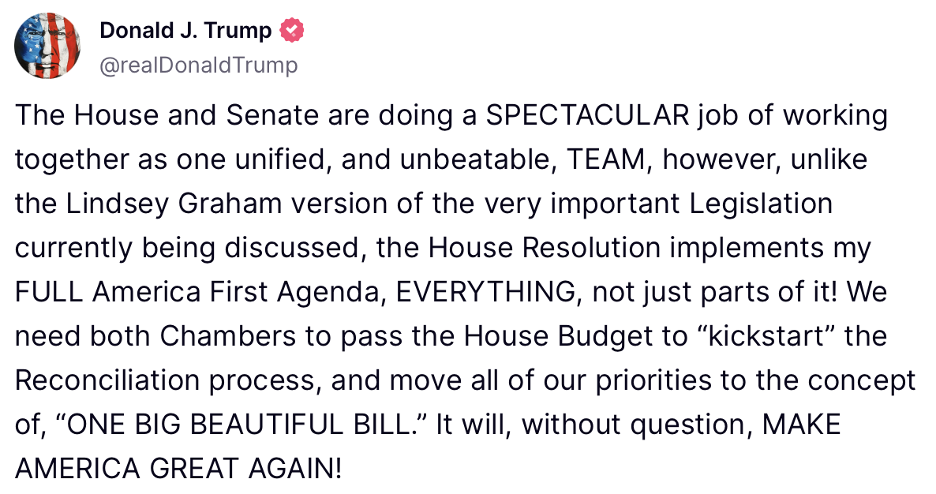

House passage of this budget is the next step toward extending the successful Trump tax cuts in one, big beautiful reconciliation bill. It also opens the door for new resources to secure America’s borders and strengthen national security as well as end the bureaucratic blockade standing in the way of American energy dominance.

Extending the Trump Tax Cuts

Permanent extension of the 2017 Trump tax cuts will fuel significant economic growth and prosperity.

- 1 million new jobs created by small businesses if the 20 percent small business deduction is made permanent.

- $150 billion in economic growth from permanent extension of the 20 percent small business deduction.

- $284 billion of new economic growth from American manufacturers.

- $50 billion in new investment in Opportunity Zones, which represent the poorest neighborhoods and communities in the country.

Key Policies from the Trump Tax Cuts Set to Expire if Congress Fails to Act:

- 6 million jobs will be lost if the tax cuts are not extended.

- The average taxpayer would see a 22 percent tax hike if the Trump tax cuts expire.

- A family of four making $80,610, the median income in the United States, would see a $1,695 tax increase if the Trump tax cuts expire.

- This is worth about 9 weeks of groceries to a typical family of four across the country.

- 40 million families would see their household’s Child Tax Credit cut in half.

- 91 percent of all taxpayers would see their guaranteed deduction slashed in half.

- 26 million small businesses would be hit with a 43.4 percent top tax rate if the Section 199A Small Business Deduction expires.

- 7 million taxpayers would be impacted by the return of the Alternative Minimum Tax.

- 2 million family-owned farms would have their Death Tax Exemption slashed in half next year.