WASHINGTON, D.C. – The One, Big, Beautiful Bill delivers key victories by making targeted changes to the tax code that will:

- Check the power of woke elites.

- End taxpayer-funded benefits for illegal immigrants.

- Defend America’s interests abroad.

- Champion life and liberty.

FACT SHEET: The One, Big, Beautiful Bill Makes America Win Again

FACT SHEET: The One, Big, Beautiful Bill Champions Life and Puts American Families First

Ways and Means Committee Chairman Jason Smith (MO-08) said:

“The One, Big, Beautiful Bill puts Americans first and ends special interest giveaways to the wealthy and well-connected. Woke universities that ignore antisemitism while amassing endowments that rival those of Fortune 500 companies will be taxed like corporations. Non-profits abusing their tax-exempt status and operating like businesses will finally be taxed accordingly. Billionaire sports team owners will no longer get a special tax break. It will push back on foreign countries who attempt to steal American tax dollars. And millions of illegal immigrants let in by Joe Biden will finally no longer be eligible for refundable tax credits and will start paying the American taxpayer back.

“While ending numerous tax breaks for elites, this legislation advances other common-sense priorities. Parents will get more tax relief to help care for their baby or to adopt a child. In total, the average family will be spared a looming $1,700 tax hike and instead, benefit from a $1,300 tax cut versus what they are paying today that helps them raise and care for their children. The One, Big, Beautiful Bill fulfills President Trump’s mandate to end insane woke ideology, replaces bad tax policy with good tax policy, and delivers for families.”

Following the October 7th Hamas terrorist attack on Israel, Americans witnessed antisemitism on college campuses across the U.S. and the abject failure of presidents of elite universities to protect Jewish students and restore order. A House committee investigation last year, co-led by the Ways and Means Committee, identified ways that universities are failing to uphold their responsibilities in compliance with their tax-exempt status. Additionally, committee hearings unveiled how “elite” universities with large endowments operate more like large commercial businesses more than centers of higher learning, often failing to use their endowments to enhance student services, experiences, and quality of education on campus. Consequently, The One, Big, Beautiful Bill taxes certain university endowments at the corporate tax rate.

Left-wing nonprofit organizations who operate like businesses will face new restrictions that recognize their manipulation of their tax-exempt status. The One, Big, Beautiful Bill increases the tax on massive private foundations that resemble hedge funds, expands taxes on nonprofits that pay their employees huge salaries, and addresses nonprofits hiding business income that is unrelated to their tax-exempt purpose. These policies come after an explosion in the tax-exempt sector in recent years and follow a Ways and Means Committee investigation that uncovered the unseen role the tax-exempt sector has been playing in funding and supporting political and ideological agendas.

The One, Big, Beautiful Bill ends taxpayer welfare for illegal immigrants – including access to Obamacare’s premium tax credits. Only Americans with Social Security numbers will be eligible for refundable tax credits. Illegal immigrants will now pay taxes on remittances sent to foreign countries.

The U.S. will no longer sit back while foreign countries benefit from President Biden’s global surrender of American tax revenue. The Organization for Economic Co-operation and Development’s (OECD) global minimum tax, known as Pillar 2 and was being negotiated by the Biden Administration, would lead to $120 billion in lost revenue flowing to foreign countries. This bill pushes back on foreign governments who attempt to determine if U.S. companies are, in their estimation, undertaxed and levy additional taxes. This provision will protect American businesses using pro-growth tax provisions, particularly the permanent research and development credit, to not have to cut jobs here in the U.S. in order to pay an unfair tax bill to a foreign country.

The legislation cuts special tax carveouts for billionaire sports team owners, further bending the tax code in favor of those Americans who President Trump has made clear should be the priority, like working families that will see no tax on tips and no tax on overtime, and seniors that will receive tax relief under the bill.

After paying a 21 percent Democrat inflation tax for four years, families will finally get more money in their pocket. Parents will benefit from a larger Child Tax Credit that is indexed to inflation, every newborn child will receive a MAGA savings account to prepare for their futures, and adoptive families will receive partial refundability of the Adoption Tax Credit.

REAL WORLD EXAMPLES: How The One, Big, Beautiful Bill Promotes Families

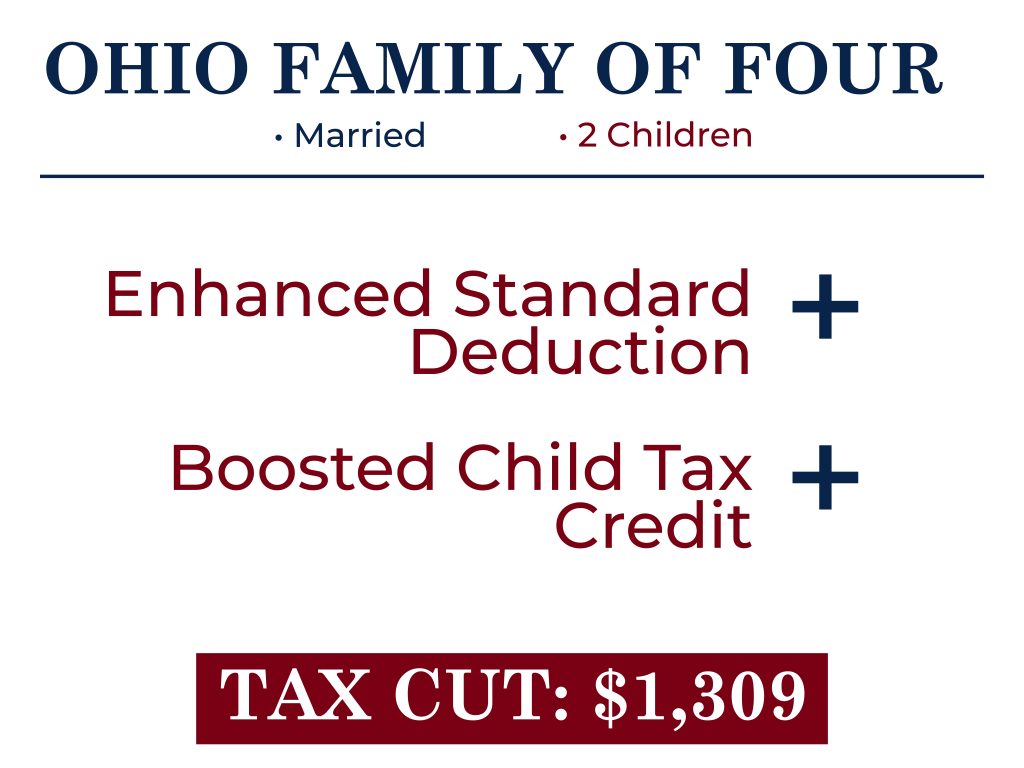

Beyond simply stopping a looming $1,700 tax increase, a married family with two children living in Ohio would get an additional $1,309 tax cut from the boosted Child Tax Credit, in addition to the enhanced standard deduction.

The legislation also supports America’s Second Amendment rights and ends the backwards taxation of suppressors as firearms.

Ending Tax Breaks for Elites and Illegal Immigrants

The One, Big, Beautiful Bill ends distortions in the tax code that favor elites at the expense of working families:

- University endowments: Subjects universities with the largest endowment-to-student ratios to the corporate tax rate.

- Left-wing organizations: Increases taxes on massive private foundations that resemble hedge funds, expands taxes on nonprofits that pay employees huge salaries, addresses nonprofits hiding unrelated business income.

- Illegal immigrants: Requires anyone who claims a refundable tax credit to provide a Social Security Number; levies new taxes on remittances sent to foreign countries; ends illegal immigrant eligibility for Obamacare premium tax credits.

- Foreign countries: Ends Biden-era global tax surrender that would send hundreds of billion in revenues abroad.

- Billionaire Sports Team Owners: Eliminates special interest tax breaks.

New Help for Parents

Parents and would-be parents will receive more help welcoming new children into their family.

- Increases the CTC by $500 – the amount had it been inflation-adjusted since 2017 and indexes the CTC amount for inflation moving forward.

- Makes the Adoption Tax Credit partially refundable, opening up more families to the joys of adoption.

- Establishes savings accounts for newborns to support growth and advancement.

- Expands 529 education savings accounts to empower American families and students to choose the education that best fits their needs, whether it is K-12 materials or obtaining a postsecondary trades credential.

Supporting Americans’ Second Amendment Rights

- Ends the taxation of suppressors as firearms.