WASHINGTON, D.C. – The One, Big, Beautiful Bill delivers relief for workers by making the 2017 Trump tax cuts permanent and includes President Trump’s priorities for hard-working Americans: no taxes on tips, overtime pay, and auto loan interest, and tax relief for seniors. Workers – who saw the real value of their wages shrink three percent because of Biden’s big government, inflationary spending – will get $1,300 in tax relief back in their pocket beyond what they pay today.

The pro-growth policies that boost small businesses, manufacturers, and farmers will also increase take-home pay by up to $11,600 and save or create 7.4 million jobs, including 1.1 million manufacturing jobs.

FACT SHEET: The One, Big, Beautiful Bill Puts American Workers First

Ways and Means Committee Chairman Jason Smith (MO-08) said:

“President Trump’s priorities are the working men and women of America who need relief after four years of spiraling price hikes created by the $10 trillion spending spree perpetrated by Joe Biden and Democrats in Washington. The One, Big, Beautiful Bill puts workers and the working-class first and provides the typical family with a $1,300 tax cut and will boost that family’s take-home pay by as much as $13,300. Permanently lower tax rates and a doubled standard deduction, combined with President Trump’s no tax on tips, overtime, and auto loan interest, will help workers afford the roof over their head, food for their families, and help build their financial security and wealth.”

REAL WORLD EXAMPLES: How The One, Big, Beautiful Bill Puts More Money in Workers’ Pockets

Middle-class Americans in different industries will benefit from new tax cuts on top of making the successful tax relief for workers in the 2017 Trump tax cuts permanent.

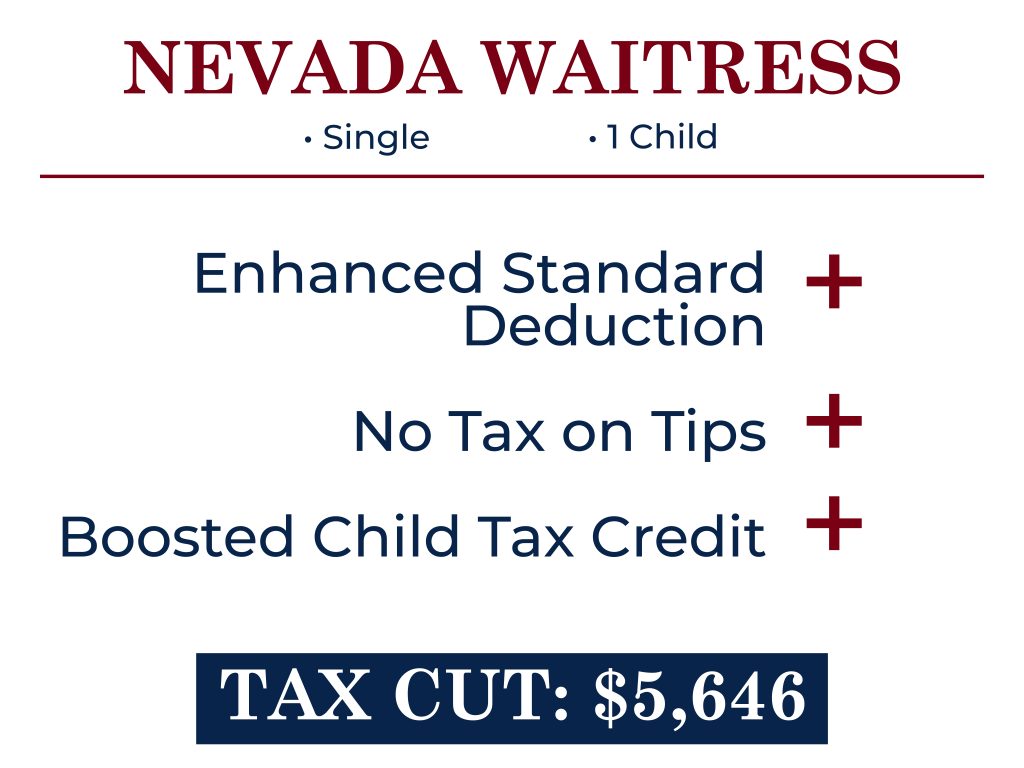

A single mother working as a waitress and living in Nevada will benefit from a $5,646 tax cut from President Trump’s no tax on tips policy, in addition to the increased standard deduction and the $500 increase to the Child Tax Credit.

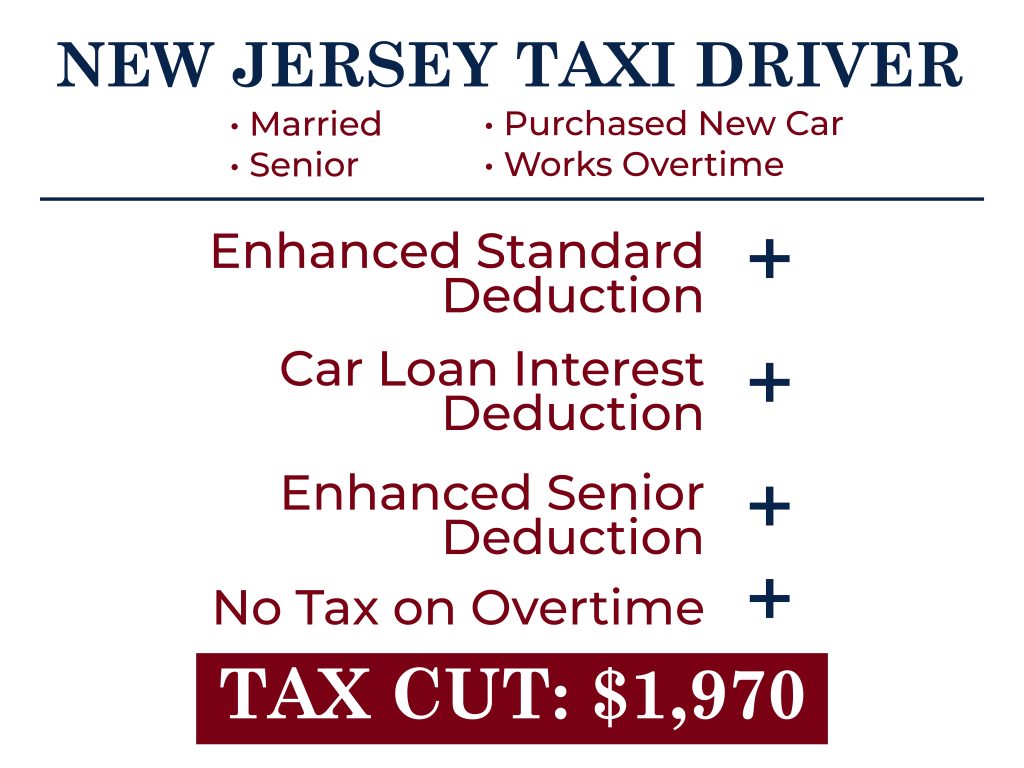

A married taxi driver in New Jersey who works overtime driving customers would have an additional $1,970 in his pocket from President Trump’s tax relief for seniors and no tax on overtime and auto loan interest, in addition to the expanded standard deduction.