WASHINGTON, D.C. – After more than four years of Democrat policies driving up prices and imposing a 21 percent inflation tax on Americans, the average family will not only no longer face a looming $1,700 tax increase, but actually get a $1,300 tax cut beyond what they pay today under The One, Big, Beautiful Bill. Working parents will get an enhanced standard deduction. 40 million families will benefit from a $500 increase in the Child Tax Credit that is then indexed to inflation.

Permanence of pro-family policies in the 2017 Trump tax cuts, including the doubled standard deduction and doubled Child Tax Credit, will save families from a looming massive tax hike.

The One, Big, Beautiful Bill gives tax relief to various types of workers and families, with the biggest reduction in tax burden coming to those who make less than $100,000.

FACT SHEET: The One, Big, Beautiful Bill Champions Life and Puts American Families First

FACT SHEET: The One, Big, Beautiful Bill Puts American Workers First

Ways and Means Committee Chairman Jason Smith (MO-08) said:

“Thanks to The One, Big, Beautiful Bill, families will get a $1,300 tax cut that removes some of the sting of four years of high prices under Joe Biden. In fact, the average household will see a up to a $13,000 increase in their take-home pay. President Trump’s pro-growth and pro-family agenda will create more jobs with bigger paychecks in communities across the country and quickly provide more relief to working families that is long overdue.”

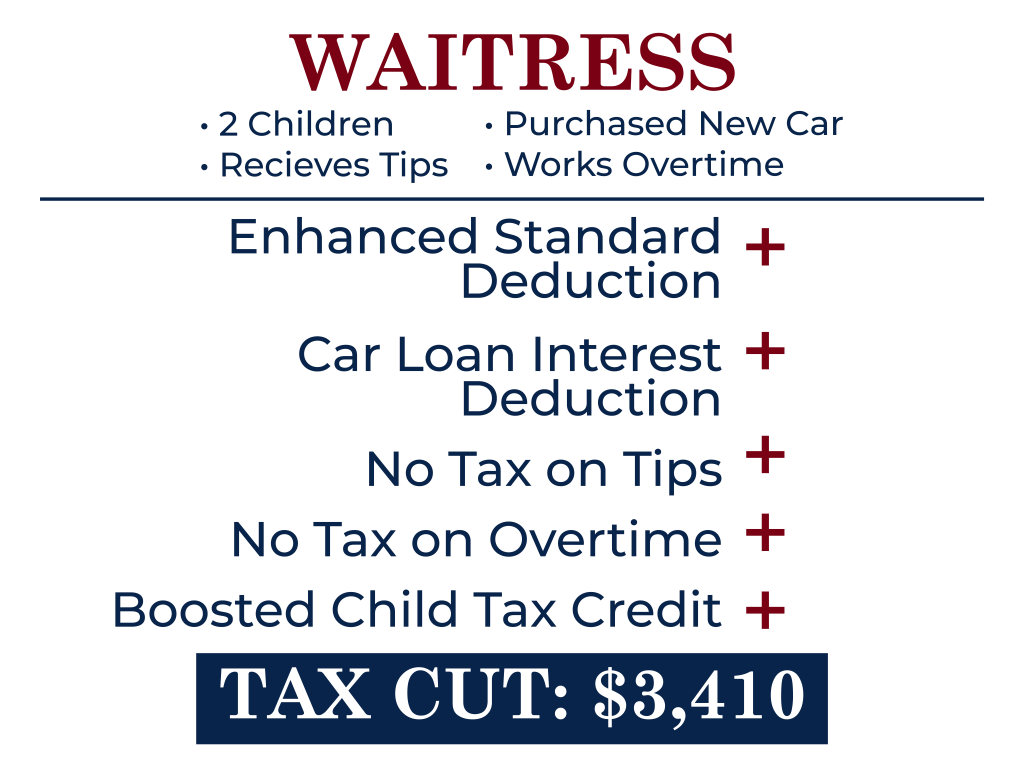

Single Mother of Two: $3,410 Tax Cut

A single mom with two children and working as a waitress would receive a $3,410 tax cut starting next year as compared to what she pays today, in part from the increased Child Tax Credit and no taxes on tips and overtime.

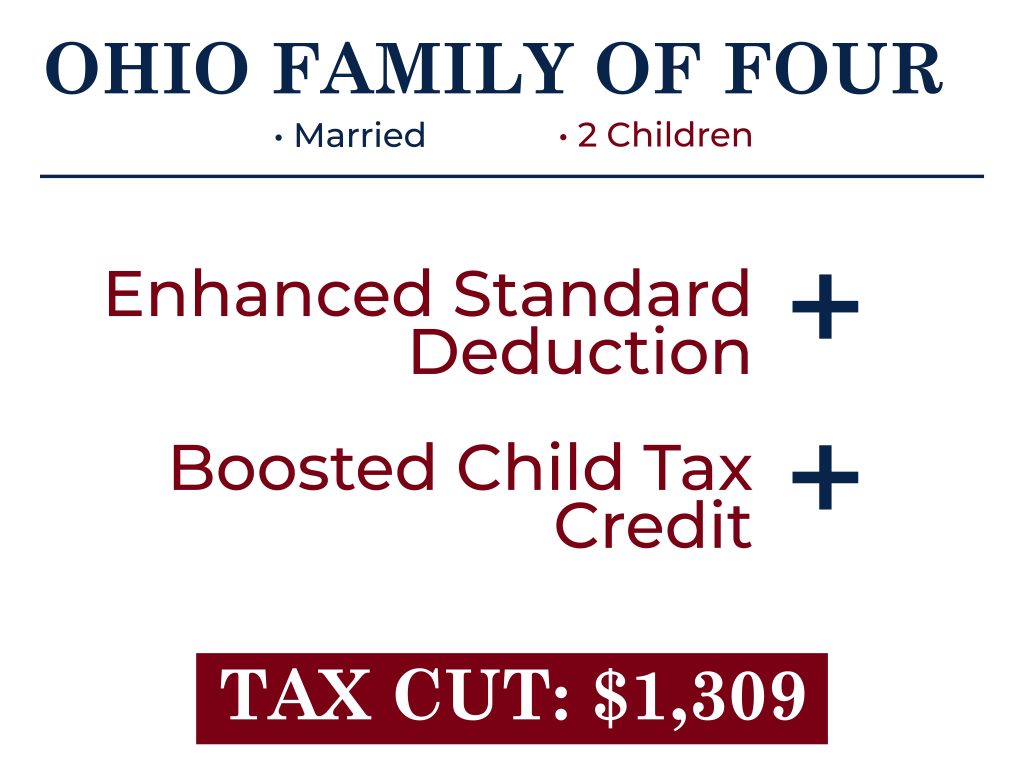

Ohio Family of Four: $1,309 Tax Cut

A married family of four with two children would receive a $1,309 tax cut compared to today, in part from the increased Child Tax Credit and enhanced standard deduction.