WASHINGTON, D.C. – The One, Big, Beautiful Bill fulfills President Trump’s promise to seniors and provides welcome tax relief after four years of inflation robbed their retirement under President Biden. Each senior will receive an additional bonus of $4,000 to the standard deduction, putting more money in the pocket of millions of low- and middle-income seniors.

FACT SHEET: The One, Big, Beautiful Bill Puts American Workers First

Ways and Means Committee Chairman Jason Smith (MO-08) said:

“Seniors spent the last four years struggling to make ends meet under Biden’s out-of-control inflation. Republicans are keeping President Trump’s promise to help seniors afford the cost of living through an expanded senior deduction in The One, Big, Beautiful Bill. This bill helps low- and middle-income seniors like my aunt who worked as a Walmart greeter to supplement her Social Security check. By keeping his promise to help seniors, President Trump is ensuring millions more Americans will be able to afford groceries and medication and enjoy a dignified retirement.”

REAL-WORLD EXAMPLES: How President Trump’s Tax Cut Helps Seniors

An additional $4,000 per senior to the standard deduction will help seniors, whether receiving Social Security or continuing to work.

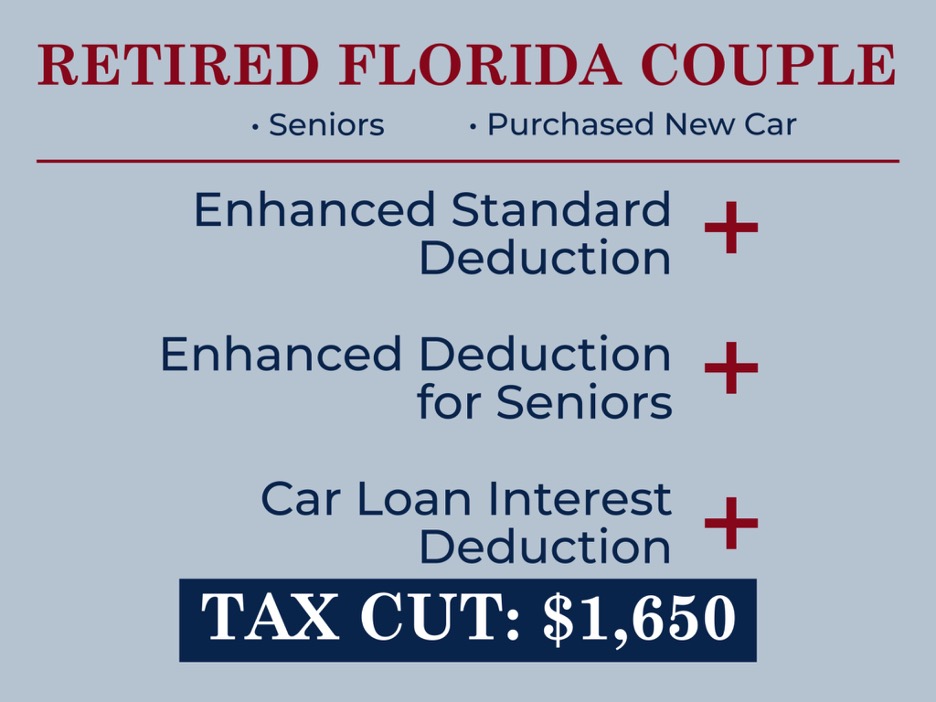

Because of policies like boosting the Standard Deduction for all filers along with an additional benefit for seniors and things like no tax on auto loan interest payments in The One, Big, Beautiful Bill, a retired couple living in Florida would receive a $1,650 tax cut as compared to what they pay today, which will help pay for groceries, housing, care, and medication.

A married senior citizen in New Jersey who earns tips as a taxi driver would have an additional $1,989 in his pocket from President Trump’s tax relief for seniors and no tax on tips, in addition to the expanded standard deduction.