WASHINGTON, D.C. – Ways and Means Committee Chairman Jason Smith (MO-08) joined Maria Bartiromo on Fox Business today to tout the economic impact of the soon-to-be-passed One, Big, Beautiful Bill. During the interview, Chairman Smith emphasized the pro-growth impact of Made in America manufacturing incentives and making permanent the successful provisions of the 2017 Trump tax cuts.

Click here or on the image above to watch the full interview.

Interview Excerpts

On economic growth…

“Maria, let’s just look at what the Congressional Budget Office estimated the growth [effects] of this bill. It was 1.8%. 1.8. If you look at the average growth rate over the last 50 years, we’ve been at 2.7%. I think it is very easy for our growth rate to be 3% or more. I believe even upwards of 5% because the provisions within this bill making permanent all the successful provisions of the 2017 Trump tax cuts, plus additional tax incentives like 100% expensing for factories in the United States. This helps promote Made in America products… There’s a lot of incentives in there to help U.S. farmers, and of course, everyday Americans, whether it’s no tax on tips, no tax on overtime, tax relief for seniors, this is going to be a mega boost to the economy, and the growth rate is going to lead to more revenues coming into the federal government’s coffers to help eliminate that deficit.”

On the Trump Administration G7 International Tax Agreement…

“This is a huge win for America. I could not be happier that 899 is coming out of the bill, because I have said all along that if these foreign governments would drop their discriminatory taxes against US businesses, we would drop 899. I was in Europe meeting with these finance ministers last week. This is something that the Ways and Means Committee has been working on for more than two years because, unfortunately, the Biden administration entered into an unbelievable, ridiculous agreement with the OECD and these foreign governments, just because they didn’t like President Trump’s successful 2017 global minimum tax.”

The One, Big, Beautiful Bill….

Brings Back and Extends Key Trump Economic Tax Policies

- Renews 100% immediate expensing.

- Businesses currently face 40% expensing for 2025, 20% for 2026.

- Renews incentive for research & development (R&D) in the U.S.

- Businesses currently must allocate R&D expenses over 5 years instead of immediately. Following the 2017 tax cuts, R&D investment grew by 18%.

- Renews deduction for interest expenses.

- Medium-sized manufacturers cannot raise capital from equity markets and often must borrow.

- Permanent Small Business Deduction.

- Increases and makes permanent the Small Business Deduction for 30 million small businesses.

Incentivizes Made-In-America

- Rewards New Factories Built in the U.S.A.:

- Enhances cost recovery for new manufacturing structures producing goods in America.

- Will create nearly 300,000 jobs and boost wages by a full percentage point.

- Doubles Immediate Small Business Expensing:

- Increases the more generous 179 Small Business Expensing to $2.5 million, allowing small businesses to invest in their employees and grow.

- Lowers Effective Tax Rate for those Producing in the U.S.A.:

- Increases existing thresholds for favorable tax treatment for small/mid-sized manufacturing.

- Renews successful Opportunity Zone (OZ) program:

- Will deliver an additional $100 billion of investment over the next decade, makes important enhancements for Zones in rural distressed communities.

- Reduces reporting burdens for small businesses and entrepreneurs:

- Stops the Democrats’ attack on the gig economy by repealing the ARPA 1099-K rule.

- Reduces paperwork burden for small businesses and workers by increasing the 1099-MISC threshold to $2,000.

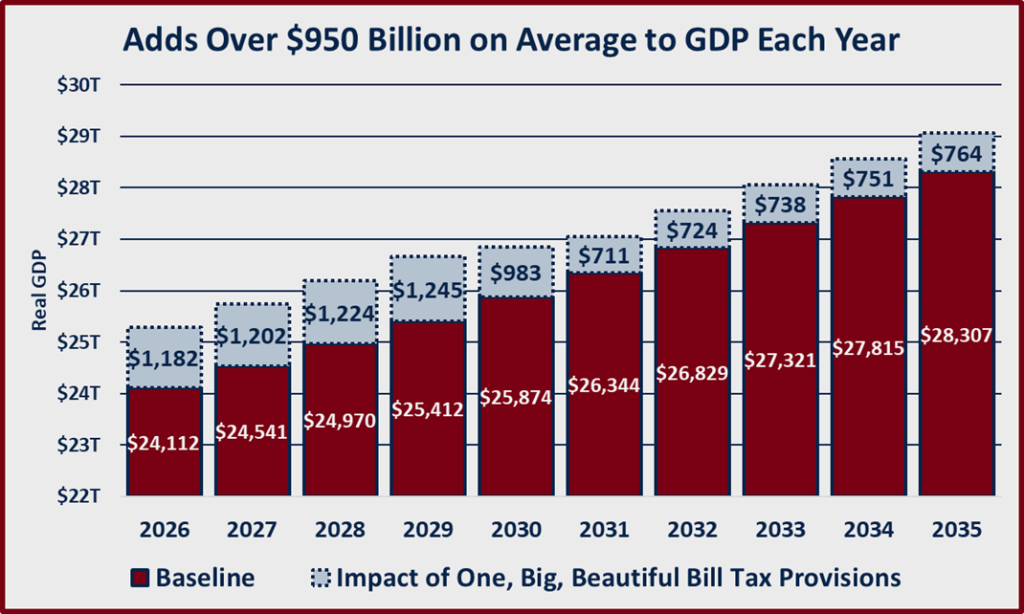

Fuels America’s Economic Growth

Economic Benefit of Policies

- Raises real wages by up to $7,200 for every American worker.

- Boosts manufacturing wages by $126 billion and ignite $284 billion in additional manufacturing-based GDP growth.

- Unlocks $1.5 trillion in additional small business GDP growth and an estimated 1 million new small business jobs annually over the next decade.

- 100% Immediate Expensing, Immediate Expensing for R&D, and Accelerated Expensing for Manufacturing Structures combined will increase investment by up to 7% and annual wages by over $1,600.

- Immediate Expensing for R&D accelerates over $20 billion of investment, and more than $50 billion long-term.

- Expanding interest deductibility will deliver a $108 billion boost to GDP.