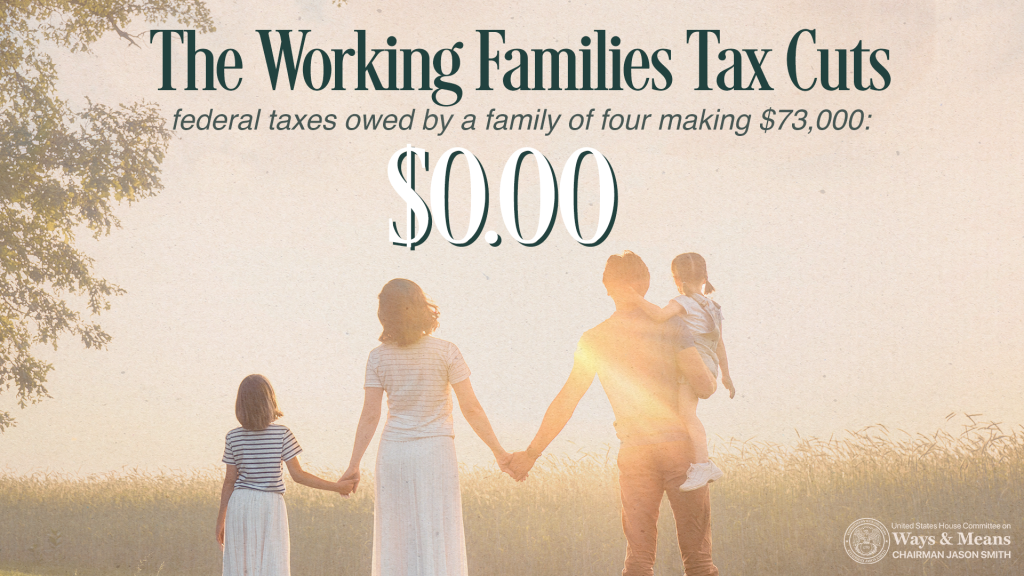

WASHINGTON, D.C. – Thanks to the Working Families Tax Cuts, a family of four with two children earning $73,000 will pay no federal income tax this year. Historic tax refunds this spring will provide further relief to the same families struggling with their cost of living.

“The Working Families Tax Cuts are delivering real relief to low- and middle-income families. A mom and dad with two kids making $73,000 will pay zero dollars in federal tax this year because Republicans in Congress took action to tackle the cost-of-living crisis left by the Biden Administration’s disastrous spending spree. This tax relief is a huge boost to the average household in my district in Missouri that earns less than this, along with millions of families like them across the country,” said Ways and Means Committee Chairman Jason Smith (MO-08). “A tax cut for working families, in addition to the bigger tax refunds coming this spring, make a real difference for the farmers, linemen, waitresses, seniors, who work hard and still struggle to get by.”

This family of four would only need to claim the boosted standard deduction and the bigger Child Tax Credit to reduce their tax liability to zero. The Working Families Tax Cuts additionally created new tax relief that directly benefits working families: no tax on tips, no tax on overtime, and no tax on Social Security.

Since the Working Families Tax Cuts retroactively cut taxes on income earned in 2025, families can expect record-setting tax refunds totaling $370 billion this tax season, a 26 percent increase over last year. The average American could receive a refund of nearly $4,000.

Read more about how tax refunds help working families afford essential needs.