WASHINGTON, D.C. – Witnesses at last week’s Ways and Means Work and Welfare Subcommittee hearing urged Congress to extend the statute of limitations beyond the initial five year period for prosecuting those who committed CARES Act related unemployment insurance (UI) fraud. The current statute of limitations is scheduled to expire on March 27, 2025 without Congressional action. Today, there are 157,000 open UI fraud complaints and the Department of Justice reports over 1,1648 open investigations.

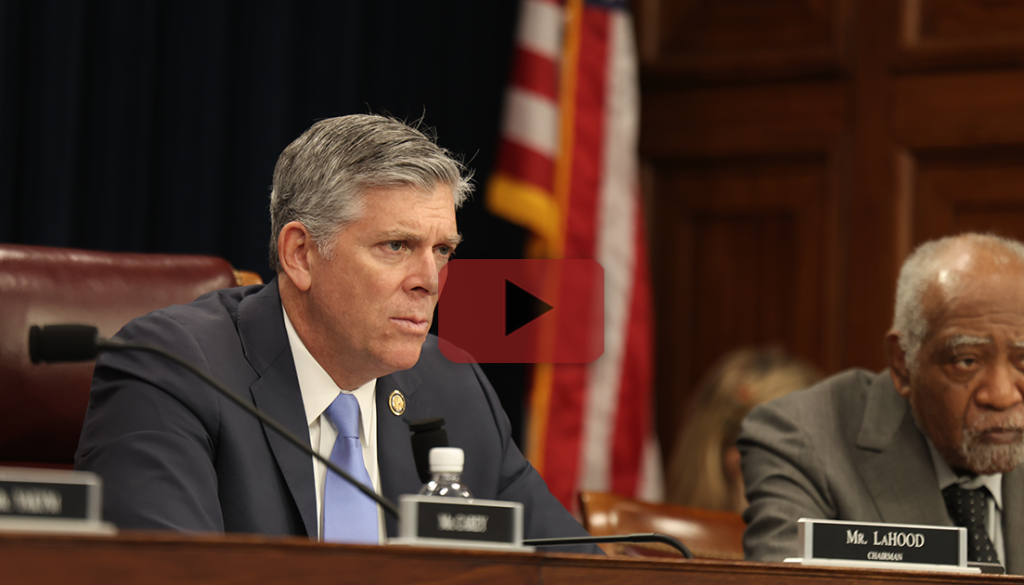

During the hearing, Work and Welfare Chairman Darin LaHood (IL-16) shared details of a dramatic recent conviction in Pennsylvania of a man who stole $59 million in public benefits, including unemployment, and funneled the funds to his co-conspirators in China. Expiration of the statute of limitations would prevent more criminals like that individual from being brought to justice and public funds from being rightfully returned back to taxpayers.

An estimated $100 to $135 billion of UI benefits from the COVID-19 pandemic were lost in the greatest theft of taxpayer dollars in American history. Of that, only $5 billion has been recovered. Ways and Means Republicans have been laser-focused for years on exposing the scale of the theft and providing states and prosecutors the tools needed to go after thieves. Last Congress, the House passed the Protecting Taxpayers and Victims of Unemployment Fraud Act, bipartisan legislation to provide states more tools and greater incentives to recover stolen UI benefits.

“Same Groups Doing Same Things”: COVID-Era Thieves Now Stealing From Los Angeles Fire Victims

Even five years after the first pandemic UI benefits went out the door, the same criminals responsible for the sophisticated theft continue to steal federal benefits. This time, they are stealing disaster benefits owed to Los Angeles fire and North Carolina hurricane victims. The continued theft of benefits highlights the need for federal and Congressional action to protect taxpayer funds, including recovering stolen benefits.

Rep. Darin LaHood (IL-16): “For years, this committee has been sounding the alarm on fraud from organized criminal organizations, particularly from a number of hostile nations, Russia, China and others. As you saw in my opening statement, I referred to a case in Pennsylvania involving a defendant caught laundering money back to China. These cases are complex. They’re nuanced, involve federal crimes, but they also raise serious national security concerns. Mr. Talcove, can you explain the current state of UI fraud and how international criminal organizations are continuing to be associated with fraudulent activity?”

Haywood Talcove, unemployment insurance expert: “I was just out in California, in Los Angeles, this week, and the fires are going there, and you are now seeing the same groups that stole at scale in California, $32.6 billion from the Unemployment Insurance Program; they’re now stealing from the disaster unemployment insurance, the disaster SNAP program. What these criminal groups do, and in particular China, Russia, Nigeria, Romania, is they use stolen information, some of it they collected directly…They have all that information, and they file claims on behalf of legitimate individuals in the afflicted areas and then they use that money for just terrible things.

“What I find incredibly frustrating…it’s the same groups doing the same thing…They use the money for horrible things, child trafficking. They use it for drugs in our communities, they use it for terrorism. I’d like to tell you that things are better today, but just watching what’s going on in California, seeing what happened in North Carolina, same groups, same playbook, stealing at scale.”

Failing to Extend the Statute of Limitations Will Results in Thousands of Criminals Going Unpunished

Today, the Justice Department has more than 1,600 cases open related to COVID-19 pandemic era fraud indicating the sheer scale of fraud still left to prosecute and stolen benefits to return. As was highlighted multiple times in the hearing, allowing the statute of limitations to lapse on fraud prosecution next month would be detrimental. Taxpayers would lose any ability to recoup the stolen benefits, and it would incentivize criminals to further target federal benefits for theft.

Rep. Rudy Yakym (IN-02): “The Department of Justice has 1,648 open cases. These are uncharged criminal matters relating to COVID-19 fraud. The Department of Labor’s Inspector General has shown approximately 157,000 open UI fraud complaints assigned to its hotline office…Do you believe that there’s still more unemployment fraud carried over from the pandemic out there that could result in prosecution or recouping funds if we were to extend the statute of limitations?”

Talcove: “Yes, I think there is.”

Unemployment Benefit Program Presents Opportunities For More Fraud Prevention Efforts

One of the lessons of the pandemic was the need to improve safeguards around federal benefits, like UI. Last year, bipartisan Ways and Means legislation, sponsored by Subcommittee Chairman LaHood and Ranking Member Danny Davis (IL-07), the BRIDGE for Workers Act, became law, which provides states with increased flexibility to provide UI beneficiaries with reemployment services and creates an additional layer of protection against improper payments. As the head of a state unemployment insurance program testified, these reemployment services are critical for getting unemployed Americans back into the workforce. Protecting against fraud in the unemployment insurance program is important to ensure eligible beneficiaries receive the help they need to reenter the workforce after a period of joblessness.

Anna Hui, Director, Missouri Department of Labor and Industrial Relations: “Thank you Chairman LaHood and Ranking Member Davis for actually getting the BRIDGE for Workers Act passed. It has afforded states a great deal of flexibility to approach individuals that have potentially more challenges to actually getting back to work. Missouri was one of the few states that actually kept our reemployment and eligibility assessment program (RESEA) going during the pandemic. By having this expansion of flexibility for states to better address what their local workforce needs are, and basically providing targeted professional workforce development services to individuals. Originally, it was for folks who are most likely to exhaust their benefits, but now it allows states to really be able to better fit what their local state needs are. This program, in particular, has the built-in component that we require somebody to report for these required workforce services if they are utilizing unemployment benefits. Their benefits are not continued if they don’t report for those, so it builds in that incentive to make sure that workforce services that are needed are actually being taken to stress the reemployment routes of unemployment itself. We really see that unemployment and workforce services as part of the two sides of the same coin. It’s really about making sure that workers have the services and support needed to get back to sustainable employment.”