WASHINGTON, D.C. – America’s working families will keep more of their hard-earned income with an average $1,300 tax cut compared to what they pay today, thanks to policies like the increased Standard Deduction and boosted Child Tax Credit in The One, Big, Beautiful Bill that passed in the U.S. House of Representatives:

Ways and Means Chairman Jason Smith (MO-08) said:

“Working families are the clear winners of The One, Big, Beautiful Bill. The over 40 million families who rely on the Child Tax Credit will get a boost. The 91 percent of all taxpayers who use the doubled standard deduction will get a bigger deduction. These policies give families the support they need to afford basic goods and services and to take care of their kids. The Ways and Means Committee heard from working parents all over America about how important lowering taxes is to helping them provide for their children. This bill stops the largest tax hike on working families in American history and instead gives them a $1,300 tax cut. Having spent the past four years weathering an over 20 percent inflation tax, the last thing American families need is a bigger tax burden at the beginning of next year.”

Additional impact of tax relief delivered in The One, Big, Beautiful Bill:

- The typical family will get up to $13,300 in additional take-home pay.

- Workers will see increased wages up to $11,600.

- Households earning less than $100,000 get a 13 percent tax cut compared to today. People who make over $1 million annually, will pay a greater share of the tax burden than they do now.

- Up to 7.4 million jobs saved and 1 million new jobs created by small businesses each year.

- No tax on tips, overtime pay, car loan interest, and tax relief for seniors will put more money annually in Americans’ pockets:

- Tipped employees will get up to $1,700.

- Overtime workers will get up to $1,750.

- Seniors will get up to $450.

- Locks in and further boosts the doubled Child Tax Credit to $2,500 for more than 40 million American families.

- Expands 529 education savings accounts to empower American families and students to choose the education that best fits their needs, whether it is K-12 materials or obtaining a postsecondary trades credential.

- Supports working families and small businesses by expanding access to the child care credit and making permanent the paid leave tax credit.

- Puts American families in control of their health care by expanding health savings accounts to millions of Americans and cementing into law a Trump Administration policy that offers more choice and flexibility for health coverage options.

- Starts building financial security for America’s children at birth with the creation of new Trump savings accounts.

The Doubled Standard Deduction Meant a Tax Cut for Working Families: The One, Big, Beautiful Bill increases and makes permanent the doubled standard deduction from the 2017 Trump tax cuts, helping the 91 percent of taxpayers who take advantage of this tax relief. During a Ways and Means hearing in Iowa, one mother warned lawmakers that allowing the tax cut to expire would have a disastrous effect on her family:

Sarah Curry, Iowa mother: “First and foremost…reducing the standard deduction would negatively impact my family because it would raise my taxable income both at the federal and the state level. We experienced benefits from tax simplicity. I didn’t have to have receipts all over the floor, trying to itemize all this stuff, trying to save a buck. We were able to take the standard. Iowa and many states use the federal taxable income as the starting point for state tax that is owed. With the reduction in the federal standard deduction, my state taxes will also go up. I’m not going to be hit once with this tax increase; I’m going to get hit multiple times over.”

The Doubled Child Tax Credit Helped Parents and Kids: The Trump tax cuts doubled the Child Tax Credit, providing $2,000 per child for families. The tax credit also included a Social Security Number requirement, ensuring its benefit went to American families, not illegal immigrants. The One, Big, Beautiful Bill makes these pro-family policies permanent and expands the Child Tax Credit to $2,500, further helping working mothers and fathers. As one mother told the Committee during a hearing:

Margaret Marple, Virginia mother: “As a stay-at-home mom and raising kids at home, there’s a lot of pressure at every angle, and a big one is financial. It influences your marriage. It influences all your decisions, especially grocery shopping and trying to meet needs for your growing family. The Child Tax Credit is a powerful form of communication, where the government communicates to people like me working behind the scenes, that my job raising kids is important to the stability and the prosperity of our country.”

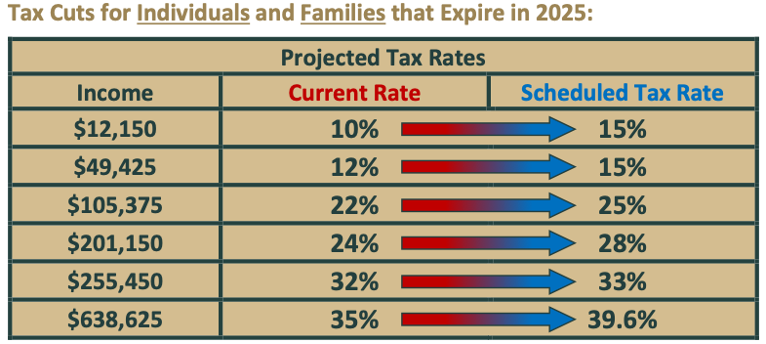

If Congress doesn’t pass The One, Big, Beautiful Bill, the average taxpayer would see a 22 percent tax hike. In fact, a family of four making $80,610 – the median income in the United States – would see a $1,700 tax increase. That’s about 9 weeks worth of groceries for a family of four.

In addition to stopping these tax hikes, The One, Big, Beautiful Bill also delivers an immediate $1,300 tax cut to the same average family of four.