Democrats Want 87,000 New IRS Agents to Audit Walmart Shoppers

Supercharging the IRS and unleashing 87,000 new IRS enforcement agents on taxpayers is a key part of the Manchin-Biden Build Back Better bill passed in the Senate over the weekend.

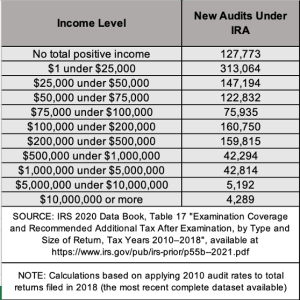

The proposal infuses the IRS with $80 billion in new funding – more than six times the agency’s current budget – to go after American taxpayers. The IRS has already been targeting lower and middle income earners, yet Democrats want to hire new IRS agents to audit individuals and small businesses. They’ve also promised to revive their invasive bank surveillance scheme.

Key Takeaways:

Lower- and middle-income earning Americans are the primary target in Democrats’ bill:

-

A Congressional Budget Office analysis makes clear that under this plan, audit rates will “rise for all taxpayers” and the policy “would return audit rates to the levels of about 10 years ago.”

-

The Joint Committee on Taxation, Congress’s official tax scorekeeper, says that from 78 percent to 90 percent of the money raised from under-reported income would likely come from those making less than $200,000 a year. Only 4 percent to 9 percent would come from those making more than $500,000.

-

Democrats voted against guardrails preventing audits for middle-income earners, instead using non-binding legislative language that would do nothing to protect taxpayers from agency abuse.

READ: Attention Wal-Mart Shoppers — More IRS Audits Headed Your Way

Democrats want to increase audits for all individuals by more than 1.2 million per year:

- A Senate Finance Committee analysis shows the $45.6 billion for “enforcement” would “predominantly hit taxpayers who have low (or very low) Adjusted Gross Income. Nothing in the proposal would change that fact.”

- Nearly half of the audits would hit Americans making $75,000 per year or less.

- Low-income taxpayers making up to $25,000 per year would see more audits too.

Despite a clear need for greater taxpayer customer service amidst a historic tax return backlog, only $3.2 billion of Democrats’ $80 billion is earmarked for that purpose.

- From the Wall Street Journal editorial board: “Despite all this new money, Americans shouldn’t expect better IRS service. The agency in the 2022 filing season answered a mere 10 percent of its phone calls.

- “The Taxpayer Advocate Service revealed in June that as of May 31 the IRS was still sitting on 21.3 million unprocessed paper tax returns, with millions of taxpayers ‘waiting six months or more to receive their refunds.’ Yet the Schumer-Manchin bill devotes only $3.2 billion for ‘taxpayer services.’”

READ: New Schumer-Manchin Bill Will Supercharge Long History of IRS Abuses

IRS mismanagement is well documented.

- An audit of the IRS itself, conducted from FYs 2010 – 2012 and published in 2013, found “inappropriate use of taxpayer funds being spent on conferences and reviews selected conferences to determine whether the conferences were properly approved, and the expenditures were appropriated.”

- Another audit in 2019 found that the IRS wasted millions of dollars on software licenses it purchased but never used due to mismanagement of IT contracts and systems updates.

- Despite the Biden Administration’s claim that more money will increase IRS audits and increase revenue from wealthy individuals and corporations, the Inspector General actually found that after spending $22 million and 200 hours auditing large businesses, the IRS was unsuccessful in bringing in money to the Treasury from those audits nearly 50 percent of the time.

For more on IRS abuses – including targeting of the middle class and political groups – click here: New Schumer-Manchin Bill Will Supercharge Long History of IRS Abuses