WASHINGTON, D.C. – Over the last year, small business owners have shared their personal experiences with the Ways and Means Committee of how pro-growth tax provisions like those now included in the Tax Relief for American Families and Workers Act make a real difference for their businesses and help them address economic challenges. During a series of hearings held in West Virginia, Oklahoma, and Georgia, small business owners frequently brought up the need for a level playing field to compete with China, lower costs to counteract three years of rising inflation, and more investment to create jobs in their communities.

Here are American small business owners, in their own words:

Boost Small Business Expensing Cap

The Tax Relief for American Families and Workers Act increases the amount of investment that a small business can immediately write off to $1.29 million, an increase above the $1 million cap enacted in 2017.

David Bergmann, President of NAECO LLC, a Georgia airplane parts manufacturer with fewer than fifty employees, shared how the small business expensing cap reduced the risk associated with purchasing new equipment that created new jobs.

David Bergmann: “Every piece of job-creating equipment in this building was purchased taking advantage of Section 179 accelerated depreciation…Sometimes, getting up to full speed can take months or even years, and meanwhile owners carry the cost of the equipment and theskilled labor. The great thing about Section 179 was that it offset some of that early risk…the timing kept us leaning into growth, instead of backing away.”

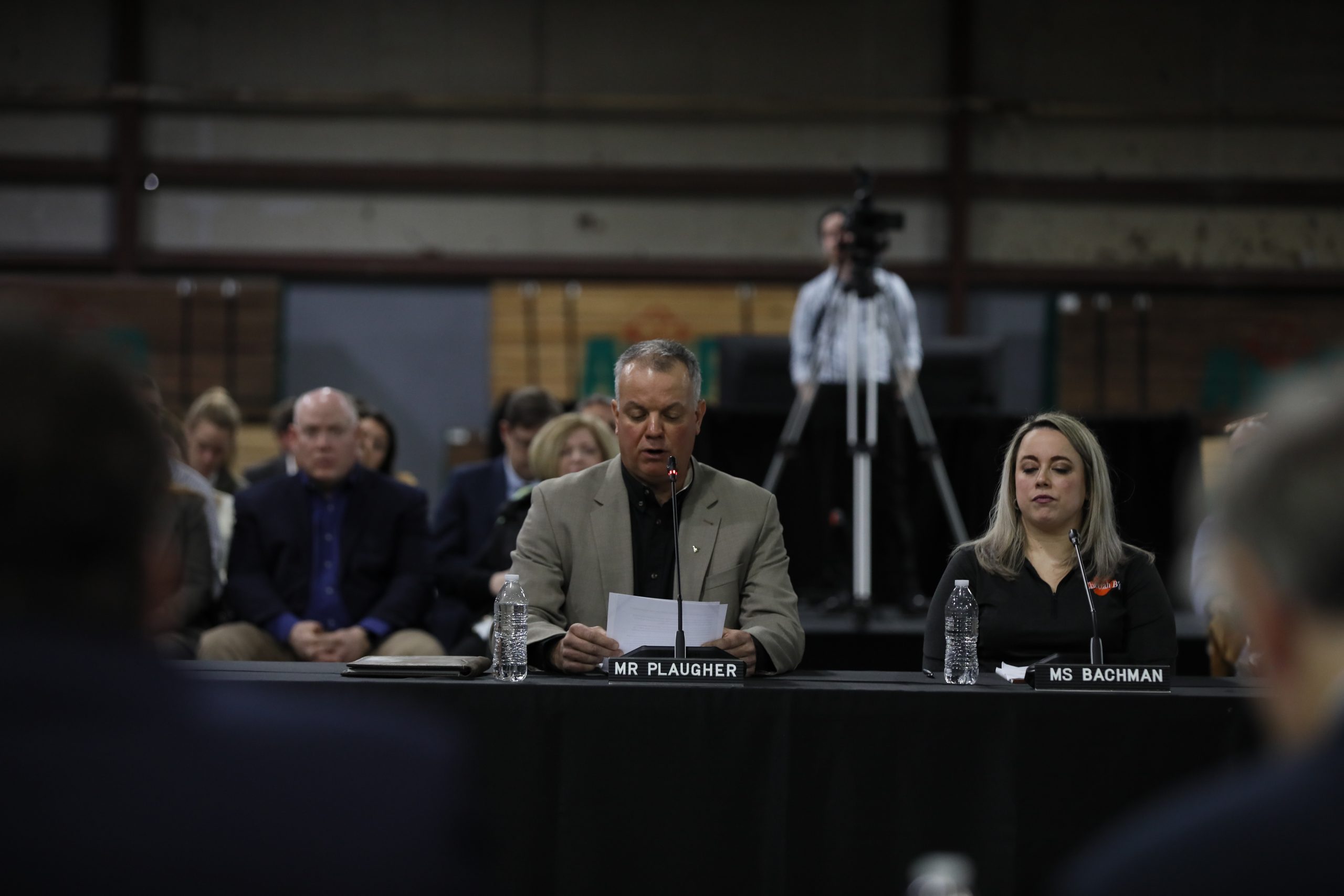

Tom Plaugher, Vice President of Operations at Allegheny Wood Products, a hardwood products manufacturer in West Virginia, told the Committee of the difficulty his small business has had in recent years acquiring new equipment needed to stay open. Increasing the cap would lower the cost of buying more productive equipment.

Tom Plaugher: “On the manufacturing plant side electronics are the biggest issue that we run into when we run sawmills. And we are entirely dependent upon contract logging companies to harvest the wood that we purchase andbring it to our mills. And that is a dying breed. As those folks cannot get access to capital, it’s a very capital intensive business.

“So it’s kind of the war on small business that’s preventing folks like that fromstarting new businesses growing existing businesses that affects our supply chain for the raw materials we need.”

Bryan Jackson, owner of a small Oklahoma meat processor with twenty employees, explained that lowering the cost of more productive equipment through this taxdeduction would help him compete against larger businesses.

Bryan Jackson: “As a small meat processor, we do more of the labor by hand, whereas large packers have the scalability of assembly lines to maintain amonopoly on output. We would be more profitable if we could [buy equipment and] process at a lower cost.”

Research and Development Expensing Enhances Small Business Competitiveness

Under the Tax Relief for American Families and Workers Act, American companies will be able to immediately deduct research and development (R&D) costs, restoring American competitiveness and innovation. R&D investment grew by 18 percent with $2 trillion invested in new facilities after the 2017 Tax Cuts and Jobs Act (TCJA) was enacted.

Lisa Winton, CEO of Winton Machine Company, a small business of less than forty employees, pointed out that the current level of the research & development deduction is making American companies less competitive against Chinese companies who benefit from a “super deduction.”

Lisa Winton: “For decades, we could immediately deduct 100 percent of R&D expenses in the year they are incurred. But as of 2022, we can only recover asmall portion of those costs each year. Meanwhile, China allows a super deduction for manufacturing R&D equal to 200 percent of research costs. That is what we are up against.”

David Bergmann, President of NAECO, LLC, a Georgia airplane parts manufacturer with fewer than fifty employees, shared how the research and development deduction affects his business and other manufacturers. If left unchanged, estimates indicate that the U.S. economy could lose over 260,000 jobs.

David Bergmann: “But from industrial capacity to logistics to workforce, everything seems in short supply for our business our size. We have an unusually ambitious R&D program… Restoring the tax treatment of R&D expenses would help us and would help thousands of other US innovators.”

Matt Livingston, owner of Coach’s Bar and Grill, a small Georgia restaurant chain that employs fewer than two dozen workers, highlighted it’s not just the innovators that benefit, but other businesses in the community who benefit when another small business is able to grow and hire more employees.

Matt Livingston: “So with these guys that are talking the research and development ideas and all that I am a firm believer that [it] needs to be part of our community… If those items don’t go into effect, and those type of businesses can’t put forth effort in the research and development side to be able to grow more. Then going back to small owners like me, it would hurt us losing manufacturing businesses and large-scale items like that… So if they can’t put in what they need to, to be able to prosper and grow, it trickles down to somebody as small as me in towns my size.”

Cutting Red Tape for Small Businesses

The Tax Relief for American Families and Workers Act increases the reporting threshold for small businesses that use subcontract labor from $600 to $1,000. By raising the threshold for the first time in almost 70 years, small businesses are free to spend less time issuing paperwork.

Alison Couch, founder and owner of a Georgia tax and business service firm that retains a small staff of just seven employees, Ignite Accounting, shared how small businesses are harmed when the IRS doesn’t update the threshold for subcontractlabor reporting, even though the agency annually updates thresholds for a slew of other tax items.

Alison Couch: “The $600 threshold the IRS imposes on small business owners for reporting subcontract labor on a 1099-NEC has not been changed since the 1950s. The burden of the reporting requirement that this places on small business owners is great. The IRS adjusts tax brackets, credit limits, mileage rates, and exclusion amountsevery year – this hasn’t been adjusted in at least 25 years.”

Supporting Small Businesses Has Proven Track Record of Helping Workersand Broader Economy

The 2017 Tax Cuts and Jobs Act provisions now included in the Tax Relief for American Families and Workers Act were instrumental in helping small businesses grow, create jobs, raise wages, and invest more in America’s economy.

- GDP growth was a full percentage point higher than pre-TCJA projections and the previous 10-year average.

- Wages grew at a rate 4.9 percent higher than inflation – the fastest two- year growth in real wages in 20 years.

- NFIB Small Business Optimism Index reached record levels, surpassing previous highs set under President Ronald Reagan.

- Existing businesses were investing in America and new business applications reached record levels (880,000 new applications).

- Though growth in business investment had been slowing in the years leadingup to 2017, after tax reform it surged. By the end of 2019, it was 9.4 percent above its pre-2017 trend.

- Core investments in equipment and other business necessities reversed theirObama-era five-year downward trend and increased to near-historic highs – making businesses and workers more productive while boosting workers’ wages.

READ: Smith, Wyden Announce Agreement on Tax Framework to Help Families and Main Street Businesses

READ: At West Virginia Field Hearing, Americans Expose the Painful Reality of Living & Working in Biden’s Economy

READ: In the Heartland, Ways and Means Committee Listens to Working Americans’ Struggles in Biden Economy

READ: In Georgia, Small Businesses Share How GOP Pro Growth Tax Plans Continue to Make a Difference